Flexi Loan Calculator Malaysia

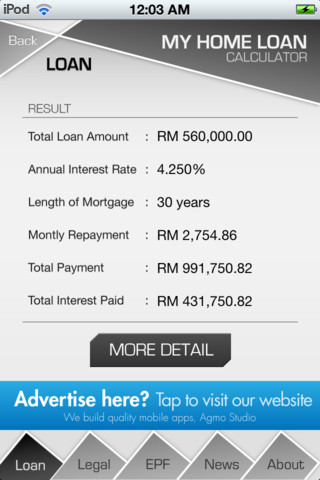

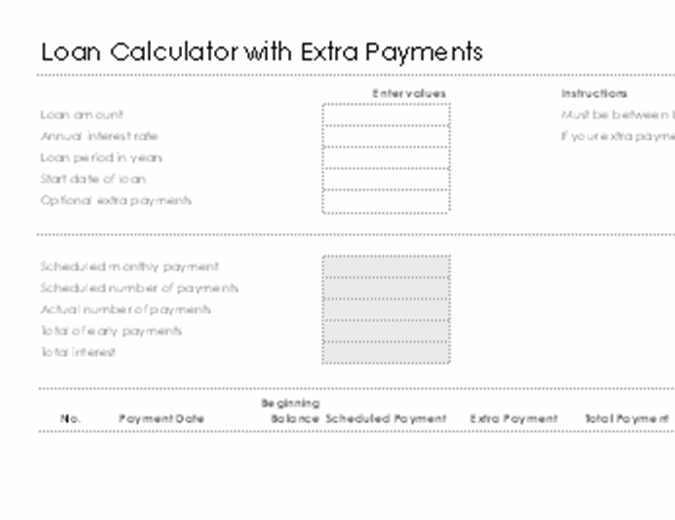

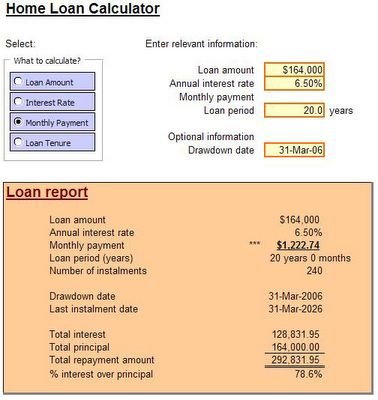

Enter loan interest rate in percentage.

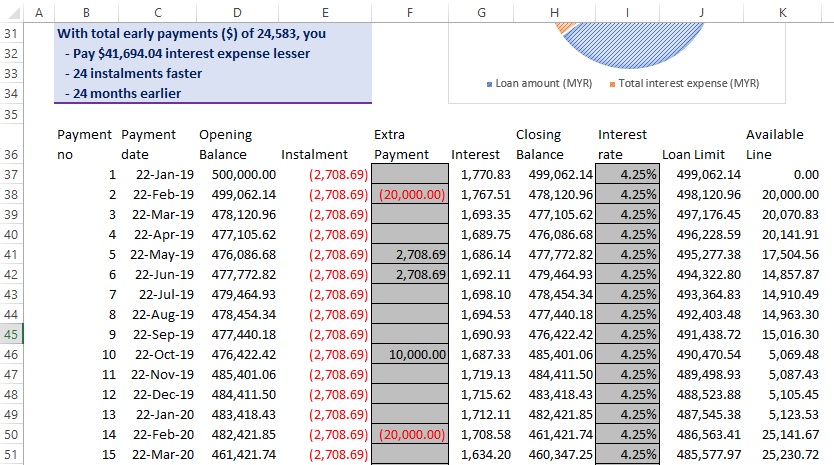

Flexi loan calculator malaysia. A combination of a loan account with a current account to facilitate the withdrawal of excess cash. The option of a flexi loan package is available and there is a maximum of 90 margin of financing. Best flexi housing loans in malaysia flexi loans let you pay money into your home loan whenever you want and withdraw that cash whenever you like. For example the price of a house is rm500 000 and you have already paid 10 downpayment rm50 000 the loan amount that must be filled is rm450 000.

They had to write into the bank explicitly to request such an arrangement to be made possible. Best semi flexi housing loans in malaysia semi flexi home loans allow you to make overpayments on your mortgage to reduce your loan principal. Making mortgage overpayments and you ll be able to reduce your home loan principal interest and tenure. You only need to fill in three indicators.

Enter property price in malaysian ringgit. Foreigners and malaysia permanent residents without cimb regional preferred or. Ocbc al amin home loan. Enter down payment amount in malaysian ringgit.

Using this home loan calculator is simple. An offset home loan account enables you to deposit more or withdraw as you please. Read the eligibility and requirement of this. Check your personal loan emi your emi amount is.

Citibank malaysia s flexi home loan provides a variable or adjustable rate mortgage that lets you save on interest charges. If you re relatively inexperienced in mortgage products read on and allow us to shed some light on the major. Base lending rate blr 6 6. There is available the option of a flexi loan package and a maximum of 90 margin of financing.

Basic term semi flexi or full flexi. Use the slider above to enter basic details such as the loan amount and rate of interest and find your monthly instalment amount displayed for your convenience. Cimb homeflexi is a flexible home loan that lets you pay extra money to your mortgage when you can afford it. Some semi flexi loans let you take money out of your home financing account.

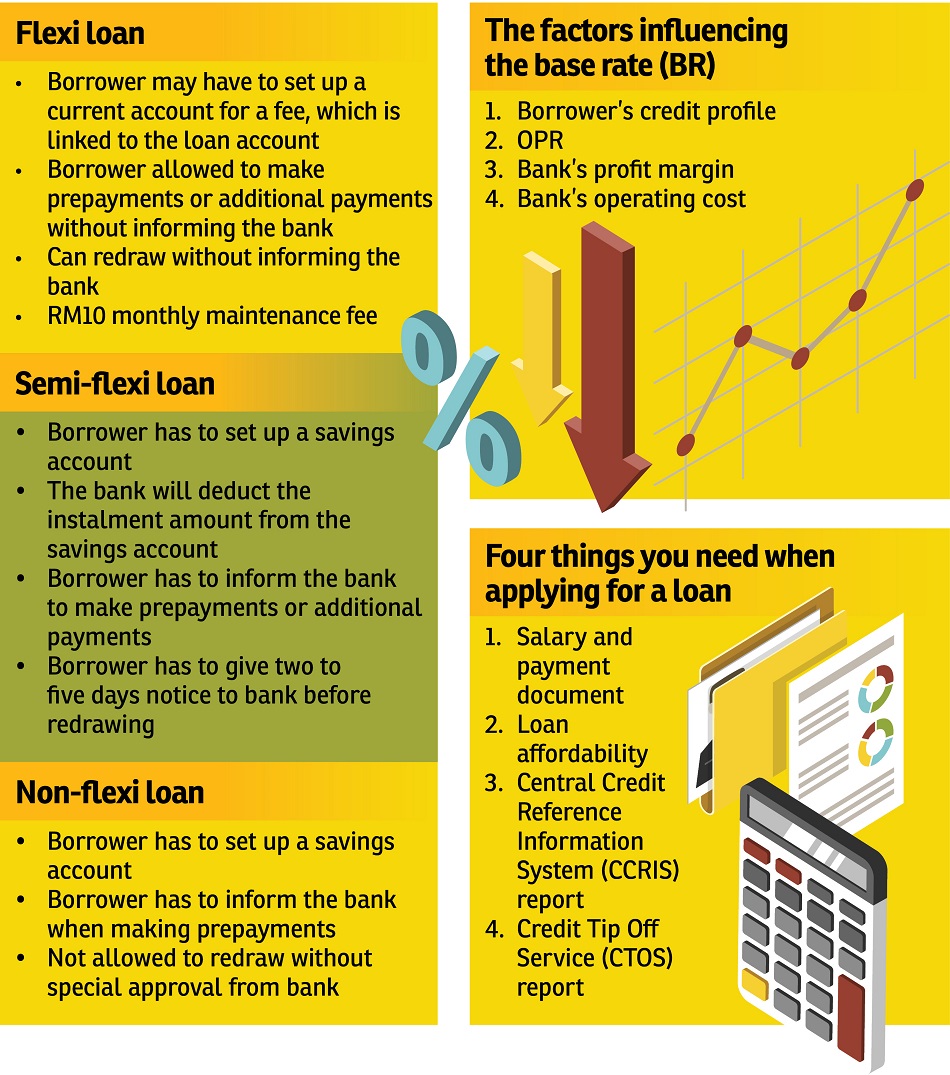

Using the flexi interest only loan emi calculator is quick and easy. In malaysia that usually means choosing from one of the three major categories. When seeking a home loan to finance a property ascertaining the type of loan you want is one of the first and most important questions you have to ask yourself. Back then all property loans in malaysia were basic term loans.

There is no lock in period for this housing loan. Generate principal interest and balance loan repayment table by year. You can calculate it from the price of the house minus the downpayment that you have paid. The faster you pay off your mortgage principal the less interest you ll have to pay and the faster you ll own your home.

The base rate br for ocbc al amin home loan is 3 92. Enter housing loan period in years. Basic term loan non flexi a term loan is a loan with a fixed repayment schedule.