Fixed Deposit Interest Income Taxable In Malaysia For Individual

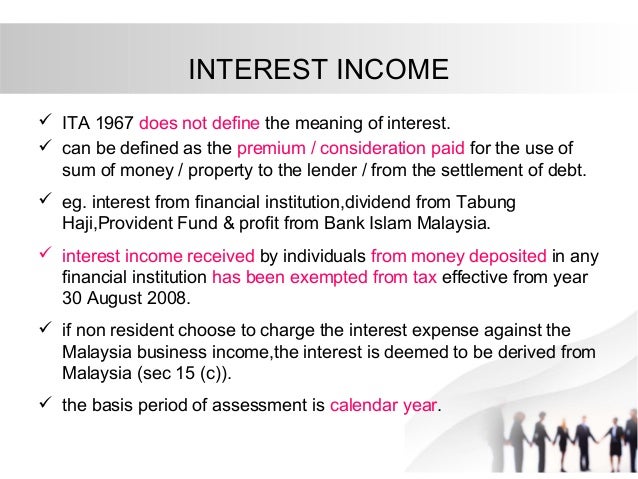

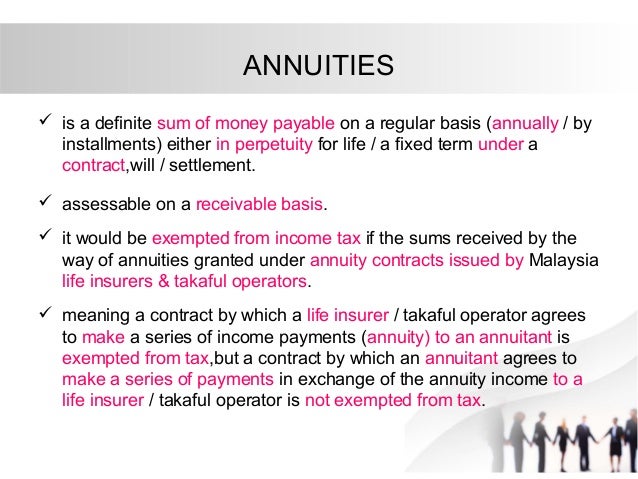

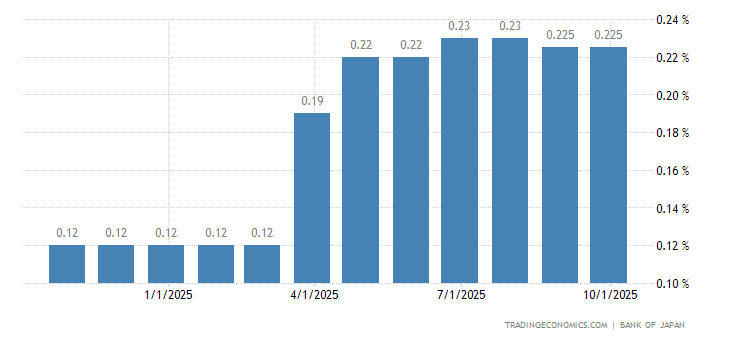

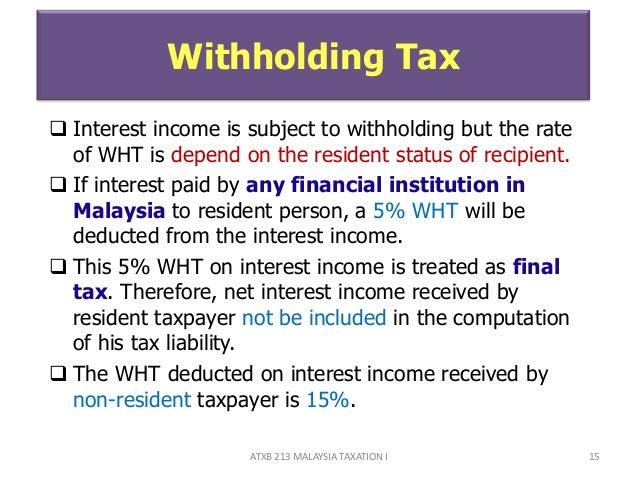

The determination of the source of interest income is significant as only interest derived from malaysia is taxable in malaysia.

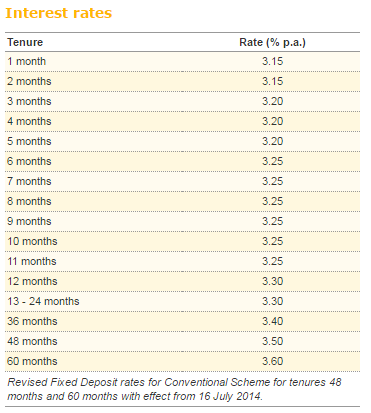

Fixed deposit interest income taxable in malaysia for individual. A savings account is probably the most basic form of investment we can have and yes the interest we earn from our bank accounts is tax free. Yes the interest income earned on bank post office fixed deposits or recurring deposits is a taxable income. That s an annual income of rm 63 000. Ben do have a rm 1 400 interest earned from fixed deposit rm 12 000 from part time job as well as rm 9 600 from property rental income a year.

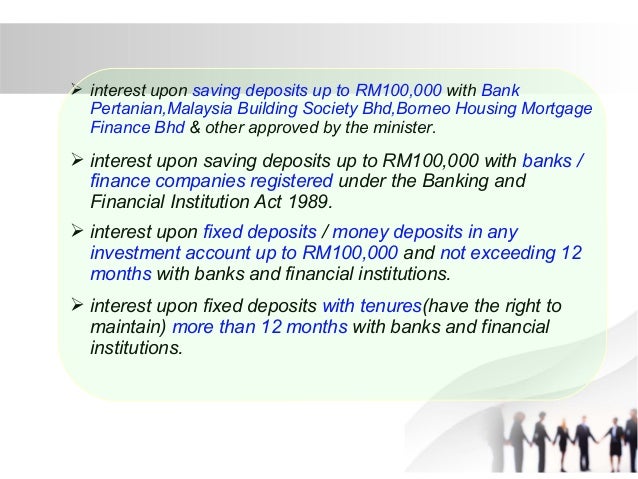

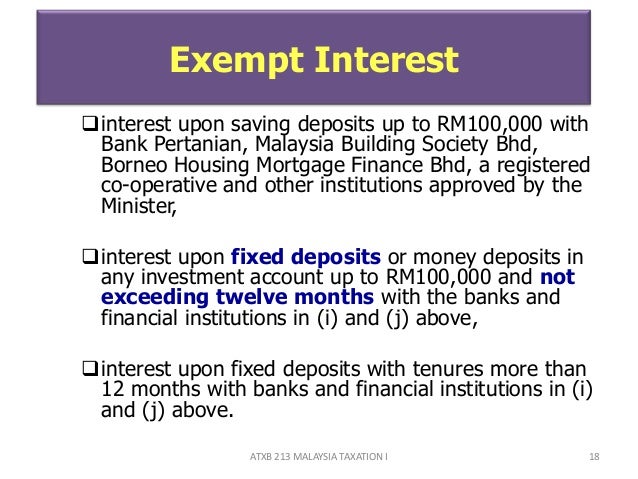

A bank or finance company licensed under the banking and financial institutions act 1989. This form cannot be filed by. Specifically any interest earned from the following institutions is tax free. A bank or a finance company licensed or deemed to be licensed under the banking and financial institutions act 1989.

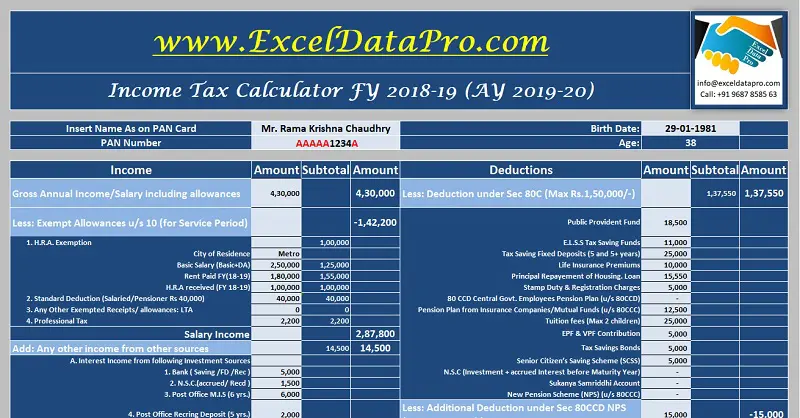

Foreign sourced interest income is specifically tax exempt. The interest income is taxable as per individual s tax slab rate for ay 2020 21. E interest arising from the excess of cash from working capital placed in the short term or long term investments example 4 carrowinds sdn bhd csb operates a theme park and casino business. Interest accumulated on fixed deposits is accounted as income and hence is taxable.

Interest received from certain types of bonds or securities is also exempt from tax. For fy 2019 20 itr 1 can be filed only by an ordinarily resident individual whose total income is rs 50 lakh or less. This itr form can be used to report income from salary one house property residuary income interest etc and agricultural income up to rs 5 000. The interest received by pmsb from the fixed deposit is interest income under paragraph 4 c of the ita.

Additionally where interest is paid to a non resident the interest derived or deemed derived from malaysia is subject to withholding provisions. However section 80c of the income tax act 1961 mention certain exceptions related to fixed deposits and other types of investments. Interest paid to a non resident individual by commercial banks merchant banks or finance companies operating in malaysia is exempt from tax. Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt.

Where do i need to declare interest on fd rd in itr. Interest that accrues in respect of any savings deposited with bank simpanan nasional bsn.