First Time Home Buyer Stamp Duty Exemption Malaysia

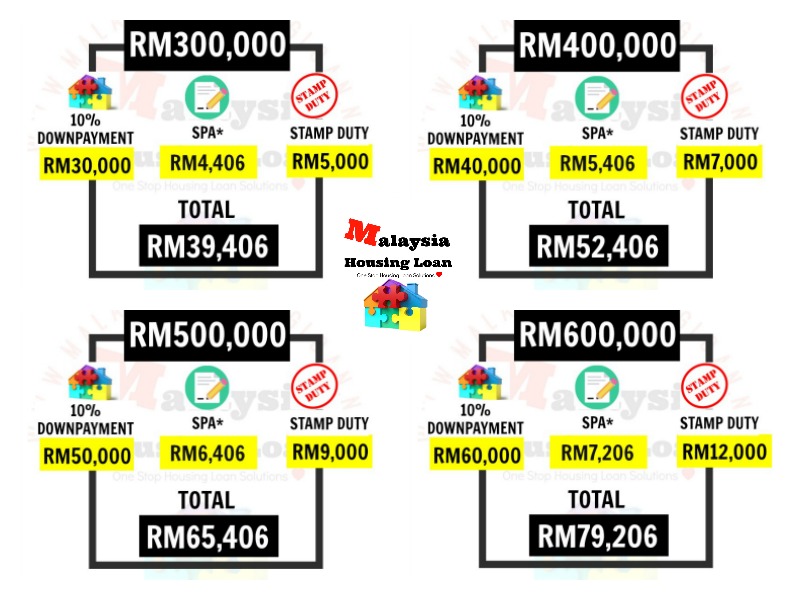

Disbursement fees to be ranging of rm1000 rm1500 00 based on estimation for first time house buyer you can check for the latest.

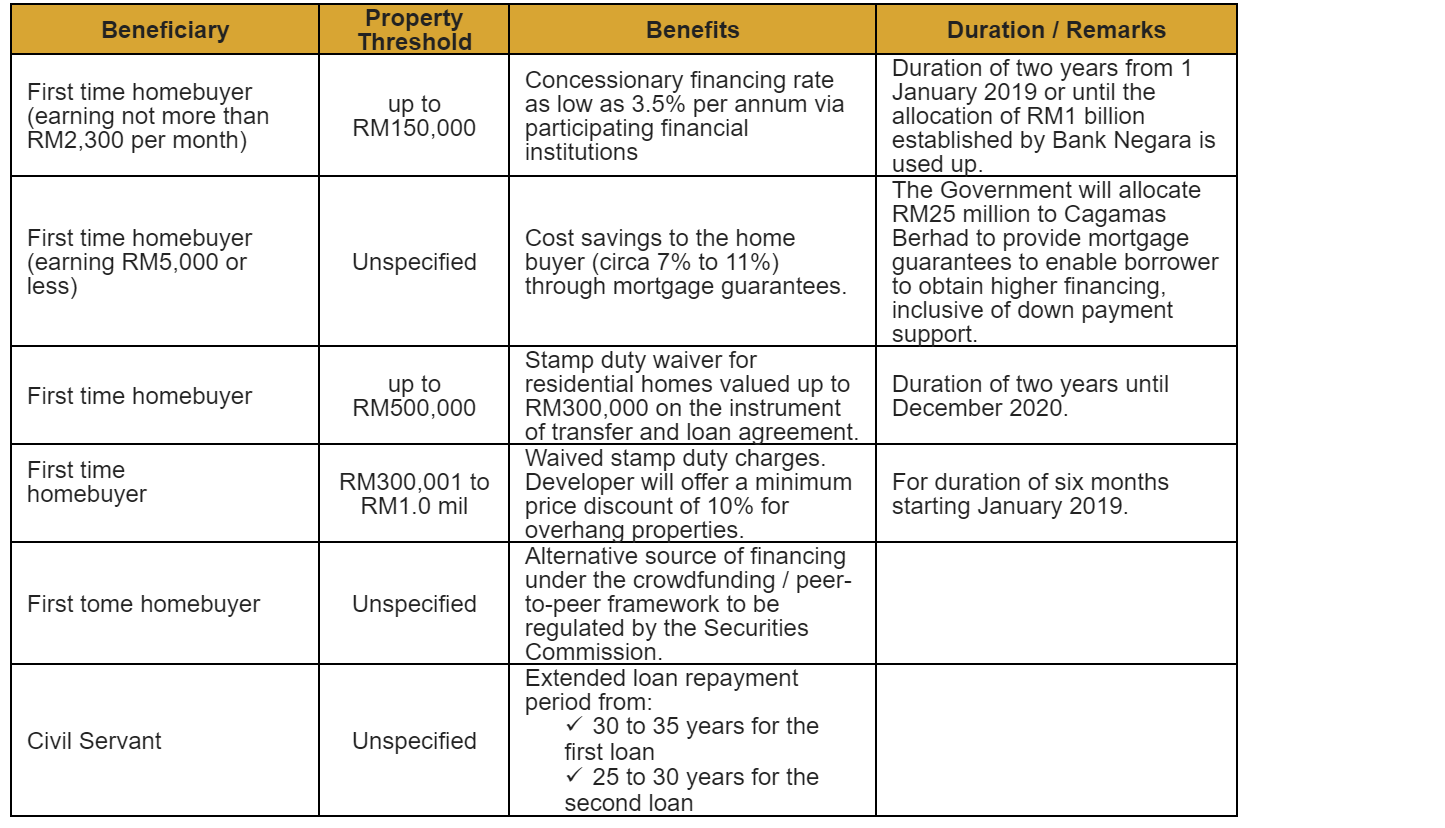

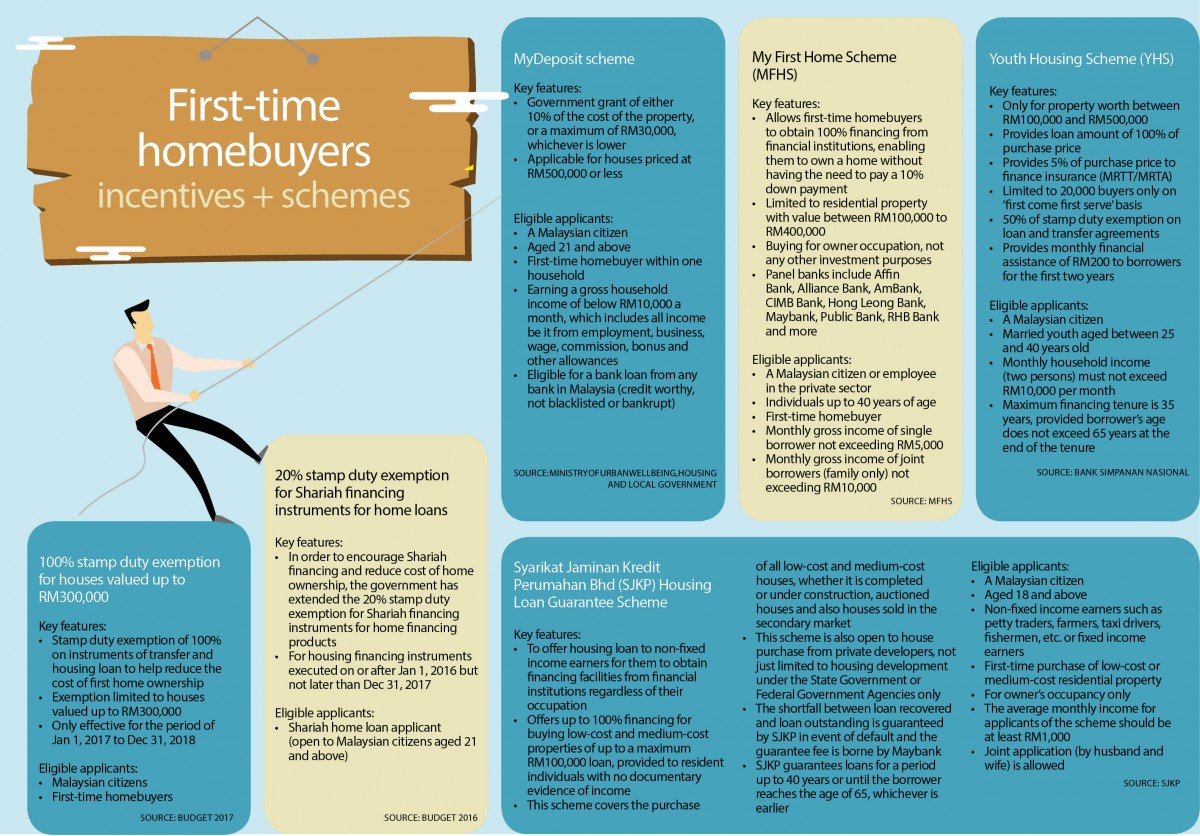

First time home buyer stamp duty exemption malaysia. For a sub sale house price between rm300k to rm500k the stamp duty exemption for first time house buyer is from 1st july 2019 until 31st december 2020. Value of instruments of transfer and loan agreement for the purchase of first home. They are applicable for sale and purchase agreements completed between jan 1 2019 and dec 31 2020. Never buy a house before and never inherited any property.

Must be first time house buyer. With the generosity of malaysian government and to increase the purchasing house for first time house buyer the government had implemented a stamp duty exemption started 2019 until 31st december 2020. Stamp duty exemption for loan agreement besides the above exemption if you are applying for a home loan for the above property the loan agreement stamp duty will be exempted too. And because of the first time house buyer stamp duty exemption you only need to pay.

Rm100 001 to rm500 000 stamp duty fee 3. So you shall pay the difference rm7000 rm5000 rm2000. If you re interested to know more about the stamp duty exemption continue reading this article until the end. Exemption given on stamp duty.

100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty. 1st july 2019 to 31st december 2020. Total stamp duty exemption for a first time home buyer is maximum rm5000. Stamp duty fee 1.

Even though everyone required to pay property stamp duty in malaysia but there is an exemption of paying stamp duty for a first time house buyer. For first rm100 000 stamp duty fee 2. How is the stamp duty calculated. Golden period to buy a house in order to address the issue of unsold homes the government has proposed a six month stamp duty exemption for first time buyers of houses priced between rm300 000 to rm1 million effective from january 1 2019 however the property purchase must be with developer only.

The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020. Between rm300 001 and rm500 000. Professional legal fees to be included 6 of sst. Remind your lawyer to apply.

You also can confirm the stamp duty exemption details with lhdn inland revenue department. First time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than rm300 000. Criteria for first time house buyer stamp duty waiver. Rm500 001 and rm1 000 000 stamp duty fee 4.

You have to apply for the stamp duty exemption.