Epf Table Rate 2019

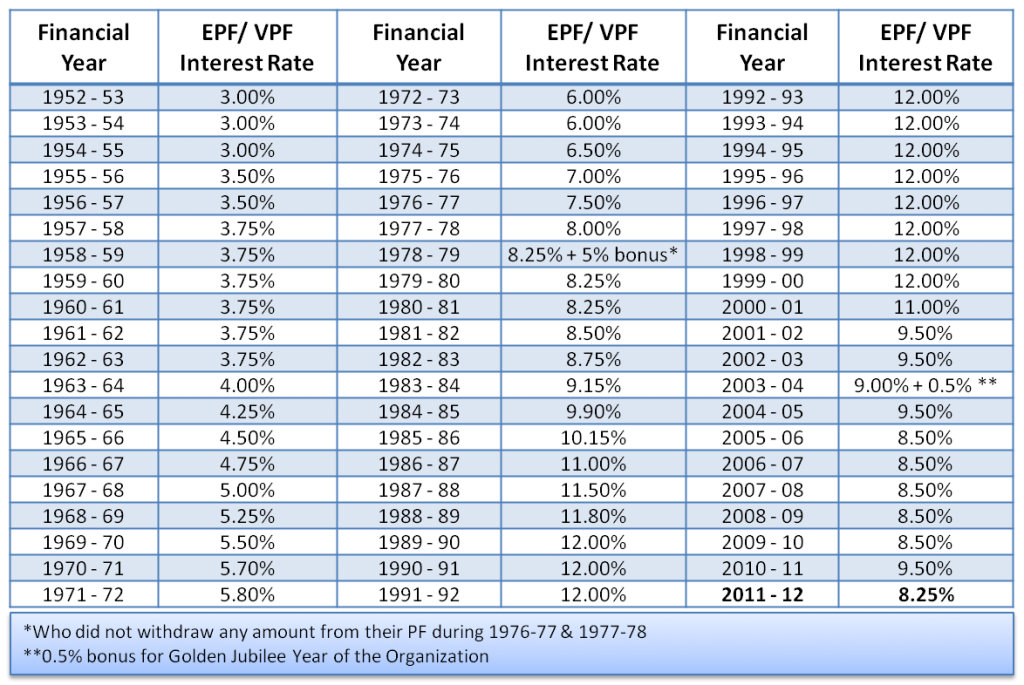

You can also check the past changes in historical epf interest rates.

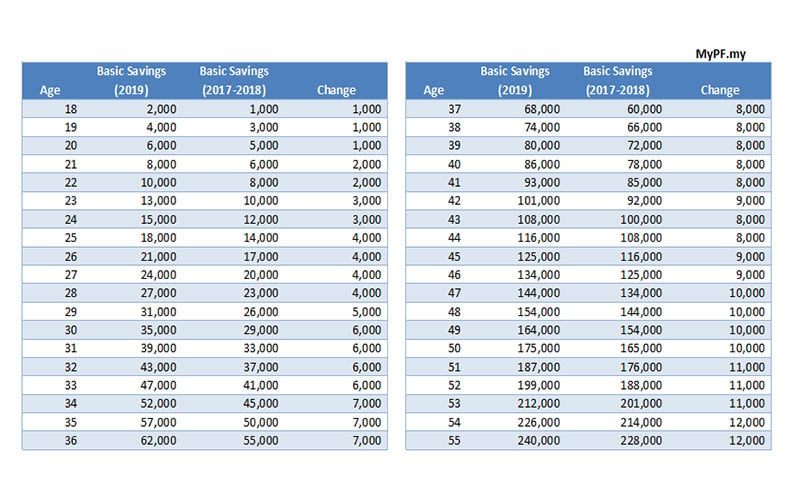

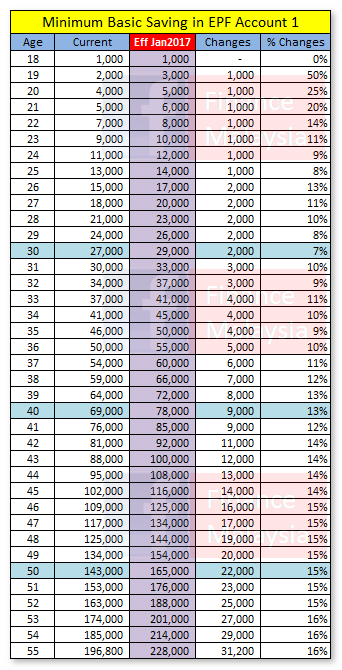

Epf table rate 2019. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. The epf said in a statement on monday the employees share of contribution rate will be 0. Meanwhile the employees share of contribution for this age group is set at zero the epf said in a statement today. The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule.

As of now the epf interest rate is 8 50 fy 2019 20. 09 04 1997 to 21 09 1997 8 33 enhanced rate 10 notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. With this 172 categories of. Kwsp epf contribution rates.

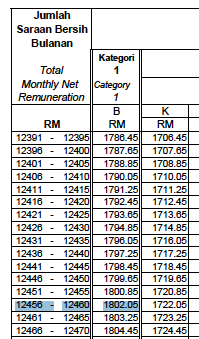

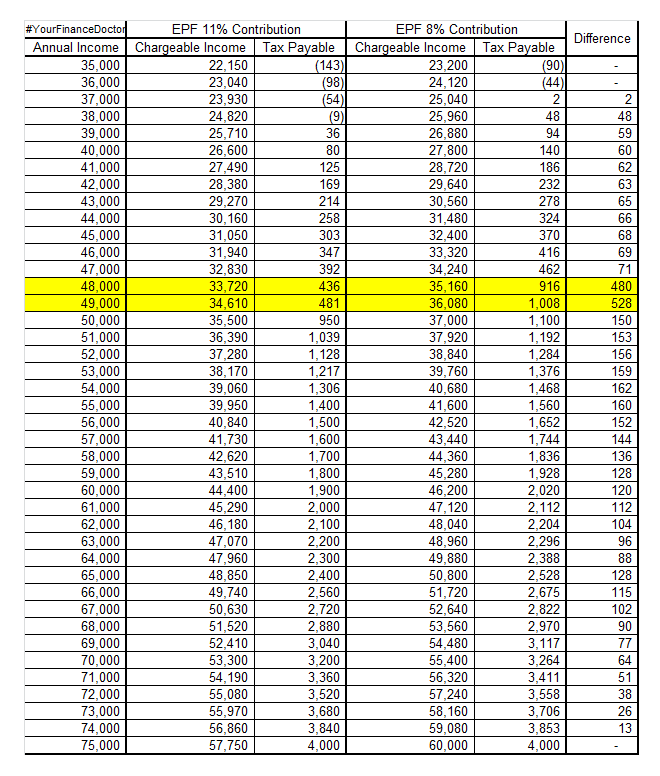

The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. But this rate is revised every year. Epf interest rate 2019 20 how to calculate interest on epf. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

As on 31st march 1991 the enhanced rate of 10 per cent was applicable to the establishments employing 50 or more persons. Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a employees who are malaysian citizens. The new minimum statutory rates proposed in budget 2019 are effective this month for the contribution month of february said epf. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.

Epf helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. Epf is a retirement benefits scheme under the employees provident fund and miscellaneous act 1952 where an employee has to pay a certain contribution towards the scheme and an equal contribution is paid by the employer as well on a month on month basis. The minimum workers share of the employees provident fund epf contribution for those above 60 will be reduced to 4 per month will start with the january 2019 salary contribution from february.