Epf How Many Percent

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

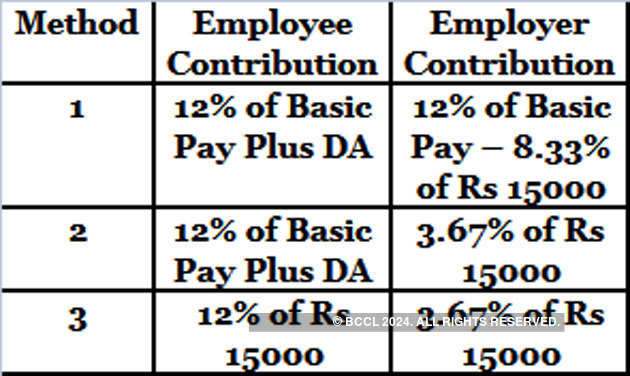

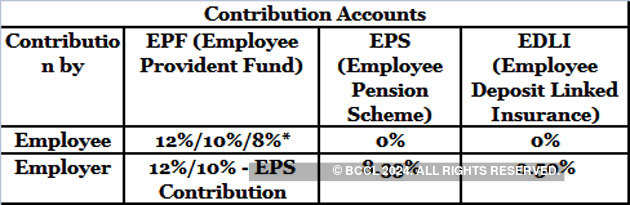

Epf how many percent. Interest on the employees provident fund epf is calculated on the contributions made by the employee as well as the employer. Total 15 67 of the contribution goes to account 1. Pension contribution is not to be diverted and total employer share goes to the pf. It is 8 5 percent for this financial year.

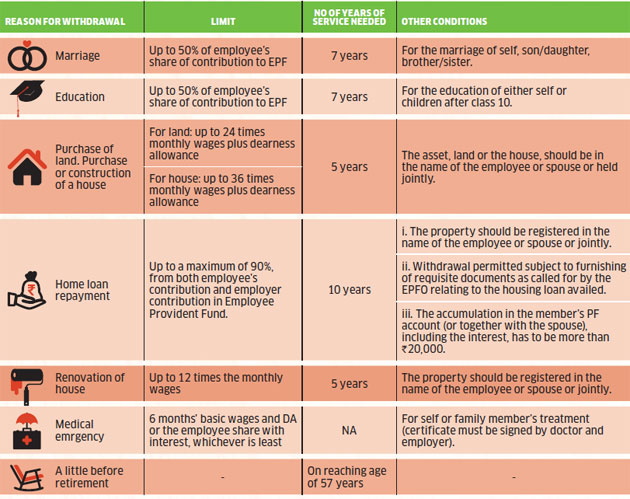

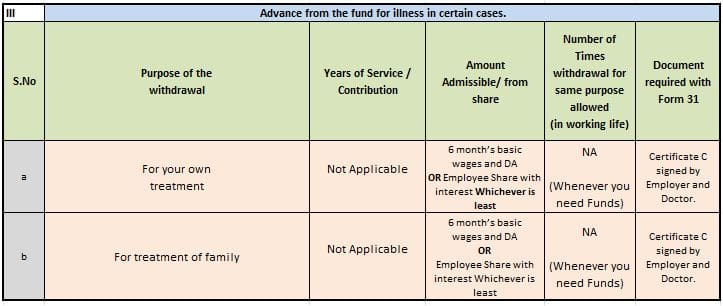

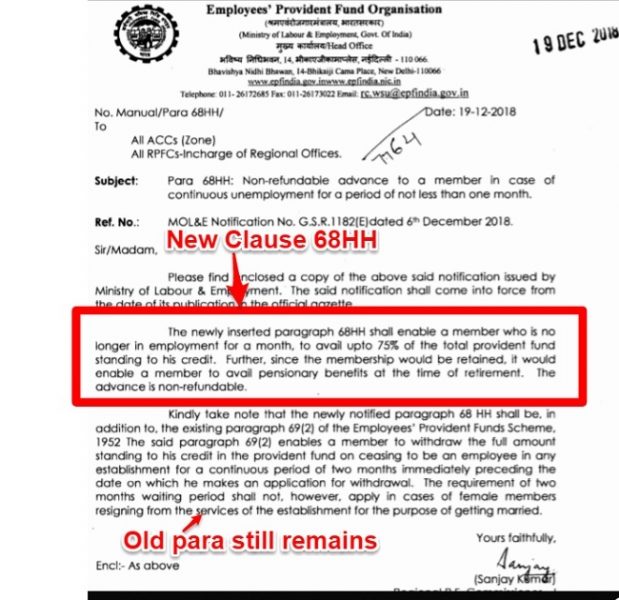

The epf account number contribution rate chart epfo account 1 ee a c 1 this account belongs to the employee share. However the person should have completed contribution to epf for at least seven years. You can withdraw up to 75 per cent of your epf account balance or three months basic wages or the amount that you actually need whichever is lower. For sick units or establishments with less than 20 employees the rate is 10 as per employees provident fund organisation s epfo guidelines.

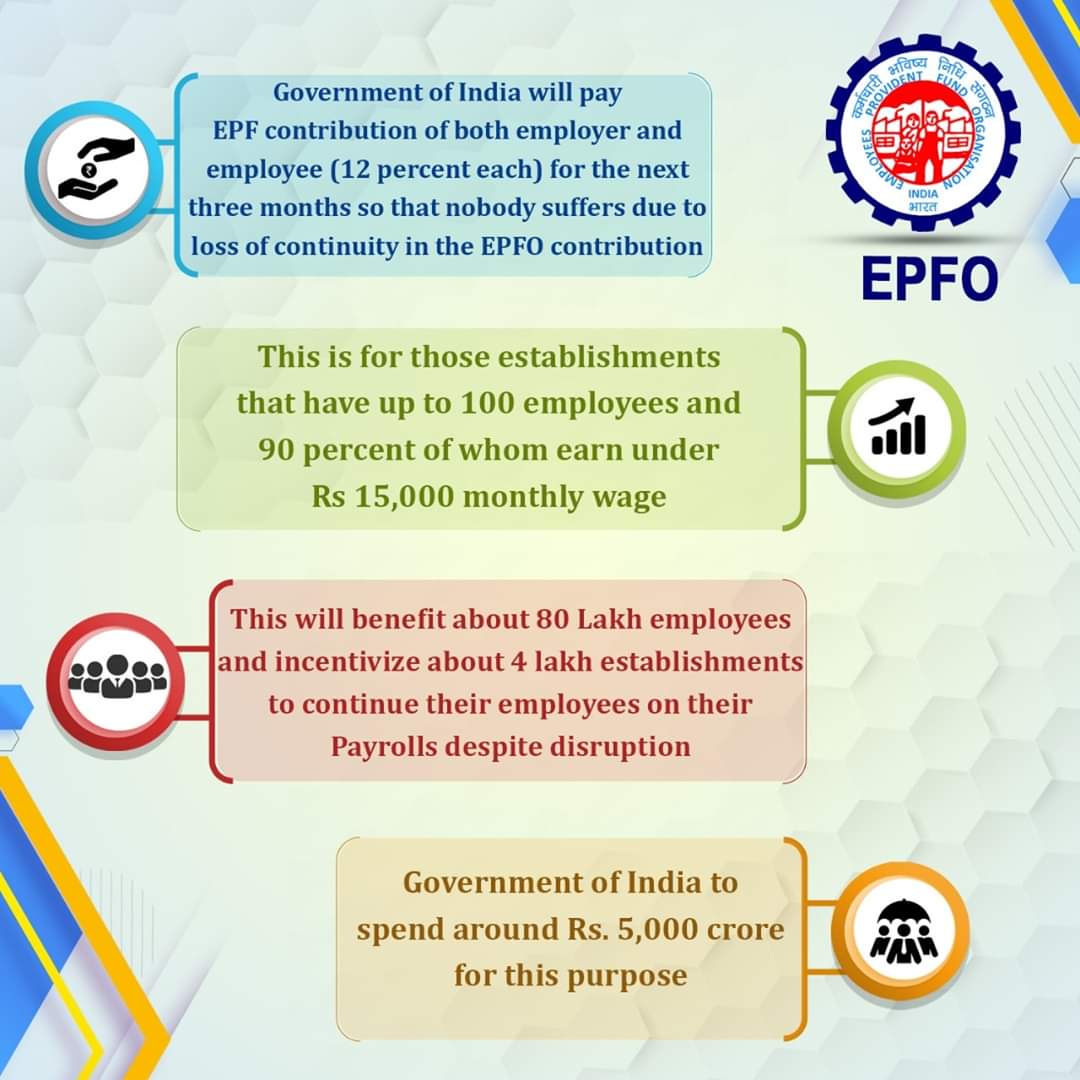

Also as per budget 2018 the rate of interest applicable on epf is 8 65. The epf interest rate is declared every year by the epfo. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. The government has allowed partial withdrawal facility in the wake on pandemic and unemployment.

Kwsp epf contribution rates. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. Members of the employees provident fund epf earning a monthly wage of not exceeding rm5 000 will be receiving a boost in their retirement savings when the revised employers statutory contribution rate of 13 percent takes effect from january 2012 wages. Epfo allows three such withdrawals for this purpose and an employee can withdraw upto 50 of his her share.

In both the cases the pension contribution 8 33 is to be added to the employer share of pf.