Epf Contribution Table 2019 Pdf

What you need to know.

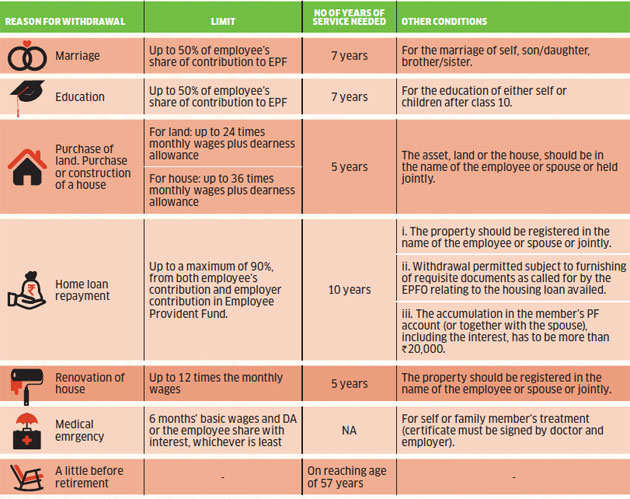

Epf contribution table 2019 pdf. The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule. And invalidity scheme second category employment injury. For late contribution payments employers are required to remit contributions in accordance with the third schedule as. As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the epf ensure orderly contributions and record keeping as well as comply with the existing policies and requirements.

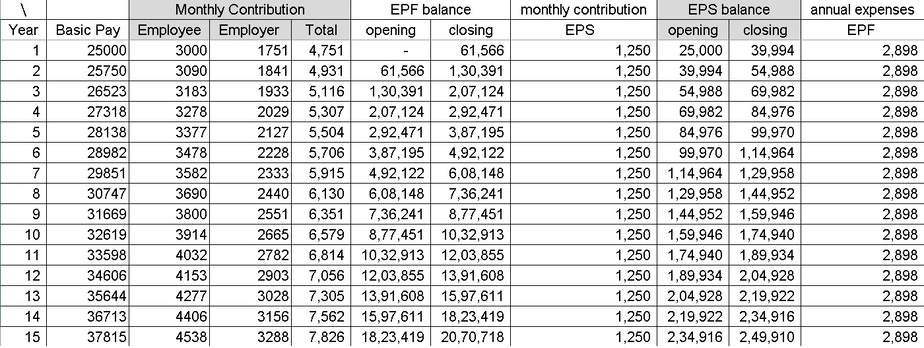

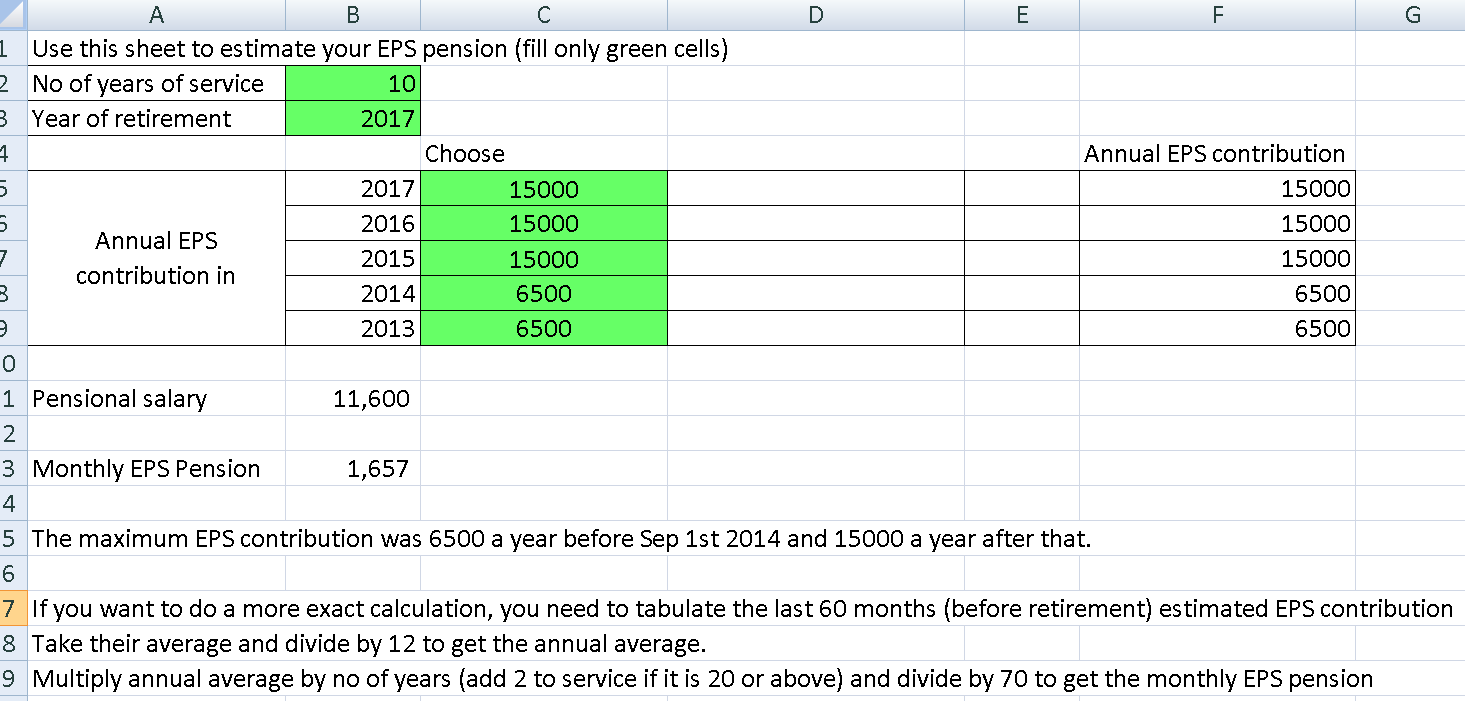

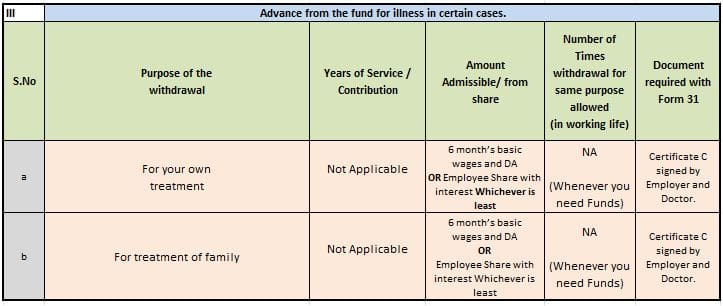

Under such circumstance your employer has to pay for both the employee s and employer s shares as well as the dividends accrued to the epf. Epf contribution third schedule. Pension contribution is not to be diverted and total employer share goes to the pf. Examples of allowable deduction are.

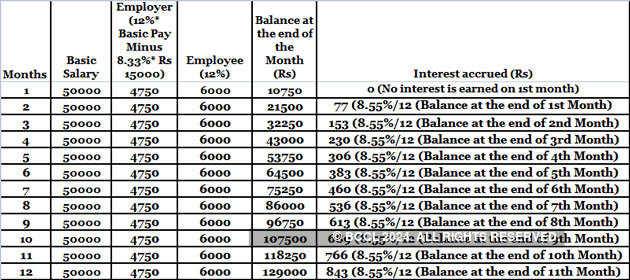

If your employer fails to deduct your salary for epf contributions at the time your salary is paid your employer cannot recover the contributions from you after a period of six months. You can find the below to table to know what details you need to. In both the cases the pension contribution 8 33 is to be added to the employer share of pf. Employers are required to remit epf contributions based on this schedule.

Download ecr file format in excel format. Employers are required to remit epf contributions based on this schedule. First category employment injury scheme. Info maintenance to epf online services on 12 september 2020 saturday 07 sep info extension of september december 2020 contribution payment date.

When wages exceed rm30 but. Start from now know more. Jadual pcb 2020 pcb table 2018. 12 jun 2019.

Sip eis table. Here you can find epf ecr calculation sheet with formulas for the year 2019. Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a employees who are malaysian citizens. Epf ecr file also known as pf calculation sheet which is used to create epf contributions text file and it is further used to create monthly epf challans.

Epf contributions tax relief up to rm4 000 this is already taken into consideration by the salary calculator life insurance premiums and takaful relief up to rm3 000. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991.