Epf Account 1 Withdrawal Age

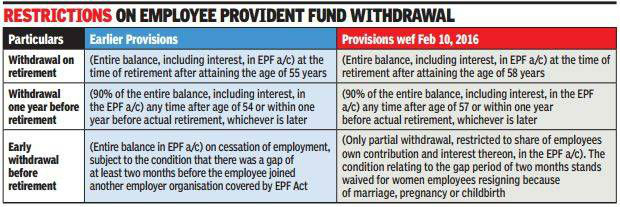

However if one withdraws before completion of five years of service tds will be deducted at the rate of 10 on the withdrawal.

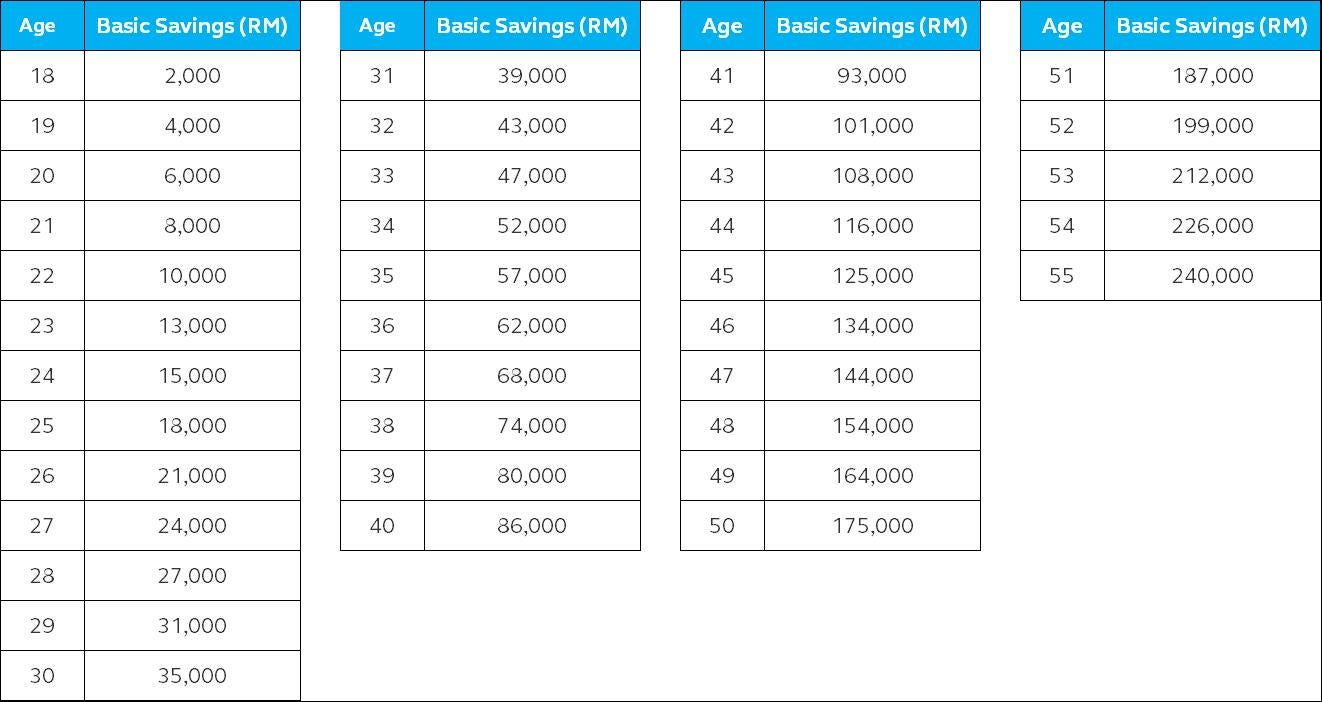

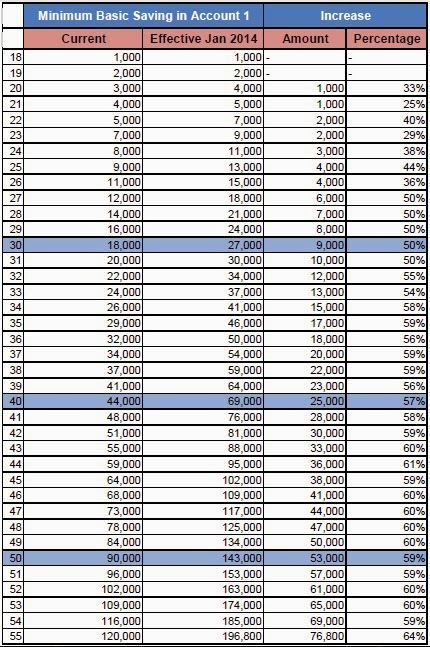

Epf account 1 withdrawal age. The epf assures members that no such steps on raising the withdrawal age have been discussed with any party at this point in time. The employees provident fund epf takes note of the world bank s suggestion to gradually raise the age when members can make full withdrawal of accounts 1 and 2 of their epf retirement savings from 55 to 65. Epf withdrawals for medical payments and equipment. The akaun emas will not affect the existing scheme where members have the option to make full or partial withdrawals upon reaching age 55.

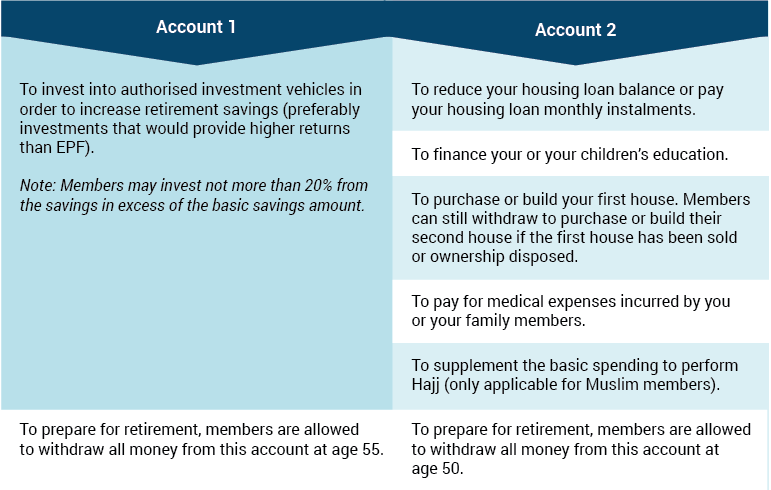

Withdrawal from account 2 to. Kuala lumpur 26 june 2020. 8 on leaving the job if you lose your job and do not get another job for a month then you can withdraw 75 of the pf money. According to the epf act in order to claim the final pf settlement you have to be 58 years of age and retire from your job.

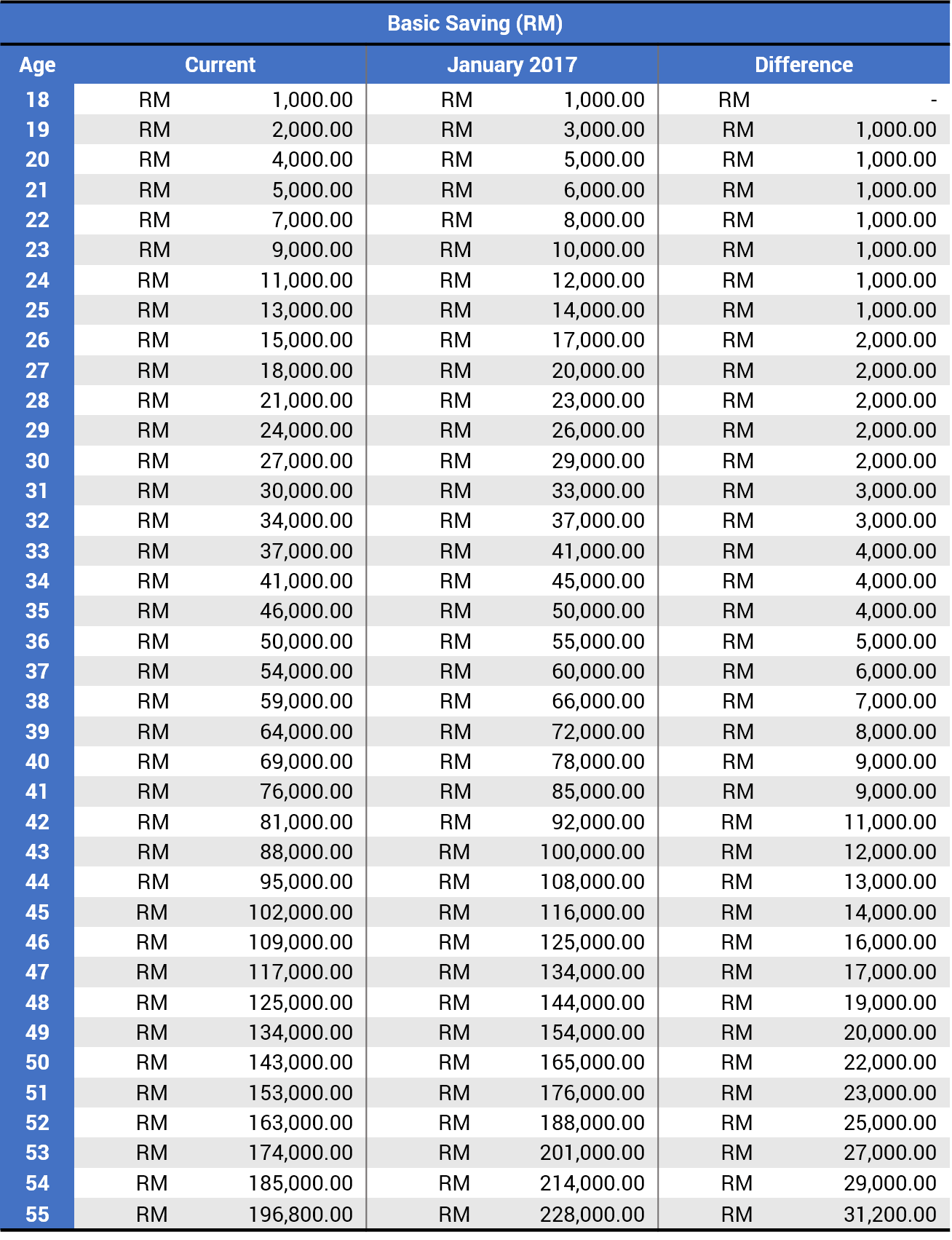

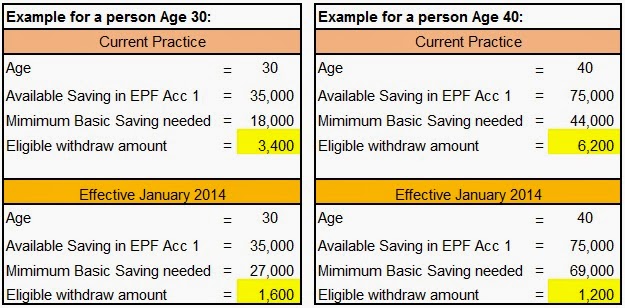

Also if one withdraws from pf after five years of continuous employment including at two different organisations with the epf balance having been transferred from old to new employer then there is no tax liability. All existing balances for members above age 55 will remain available for withdrawal. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. If you have taken retirement before time then you can withdraw up to 90 of your total pf balance provided you are 54 years of age.

When you reach a certain age owning your own home will be high on your list of things to. When members turn 55 they can make withdrawals and have access to savings in akaun 55 anytime. The epf however said it has taken note of the world bank s suggestion to gradually raise the age when members can make a full withdrawal of accounts one and two of their epf retirement savings from 55 to 65. When you reach a certain age the epf allows.

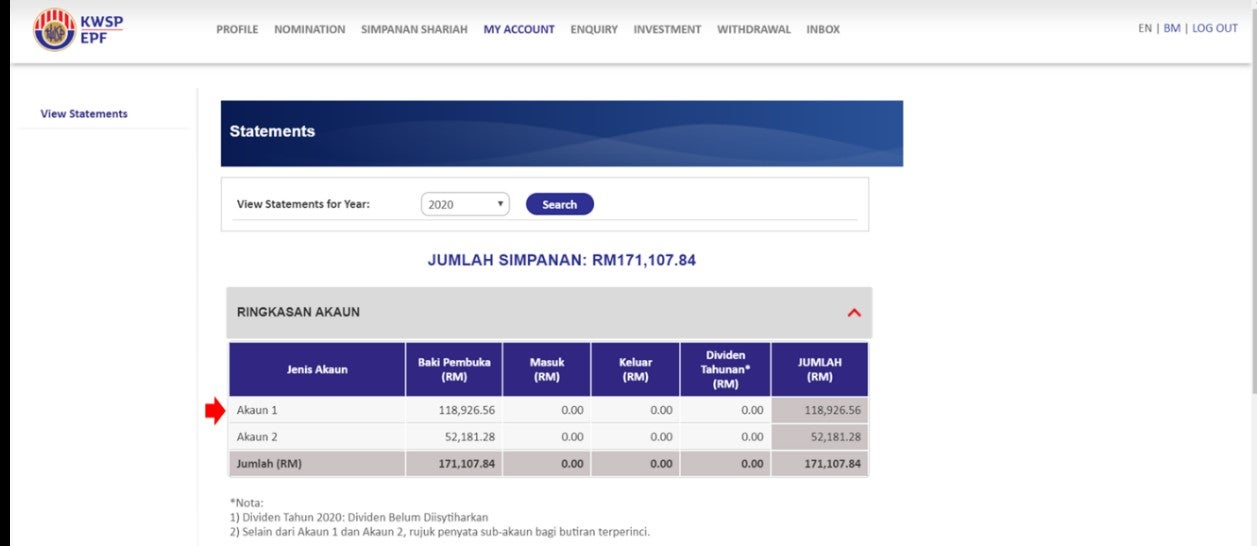

Upon reaching age 55 your savings in akaun 1 and akaun 2 will be combined and put into this account. About age 55 withdrawal upon reaching age 55 the contributions made to your account 1 and account 2 will be consolidated into account 55. Age 50 55 60 withdrawal. They can perform a lump sum withdrawal monthly withdrawals or partial withdrawal.

The epf assures members that the current age 55 withdrawal will remain. You can do this only once. This is the most common form of epf withdrawal. Full withdrawal at age 55 remains.

You can withdraw all or part of the savings from this account at any time.

.gif)